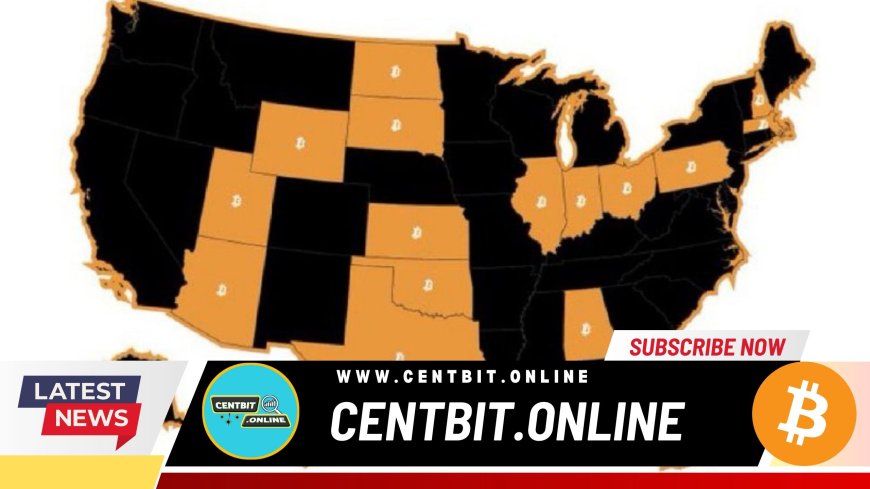

At least 15 U.S. states are actively considering or have proposed legislation to establish strategic Bitcoin reserves, a move that could reshape the financial landscape. States leading this initiative include:

✅ Texas

✅ Pennsylvania

✅ Ohio

✅ New Hampshire

✅ North Dakota

✅ Utah

✅ Florida

✅ Massachusetts

✅ Wyoming

✅ Oklahoma

✅ Arizona

Bitcoin’s Legitimacy as a Reserve Asset Strengthens

As state governments accumulate BTC, it further cements Bitcoin’s status as a legitimate reserve asset, bringing it closer to mainstream financial systems. This trend aligns with corporate giants like MicroStrategy and Tesla, as well as nation-states like El Salvador, which have already integrated Bitcoin into their financial strategies.

Increased Institutional Confidence → Higher Bitcoin Demand

State-Level Accumulation → Potential BTC Supply Squeeze

Regulatory Recognition → Accelerated Adoption

Altcoins to Follow as Liquidity Flows into Crypto

Bitcoin’s dominance often paves the way for capital inflows into the broader crypto market, leading to a surge in altcoins. With institutional players entering the space, altcoins like Ethereum, Solana, and XRP could see a major boost.

State BTC Reserves = Institutional Endorsement

Rising Demand = Higher Prices Across the Market

Altcoin Growth = Expanding Crypto Ecosystem

Final Thoughts: The Future of Bitcoin as a Strategic Asset

This initiative could mark a turning point for crypto adoption, making Bitcoin a recognized part of state financial reserves. With growing institutional confidence, we might witness one of the biggest supply shocks in Bitcoin history, fueling long-term price appreciation.

Are we on the verge of nationwide Bitcoin adoption? Drop your thoughts below!

Stay updated with the latest crypto trends on CentBit.Online — Bangladesh’s Leading Crypto & Blockchain Expert!