Bitcoin Halving: A Proven Catalyst for Massive Price Surges

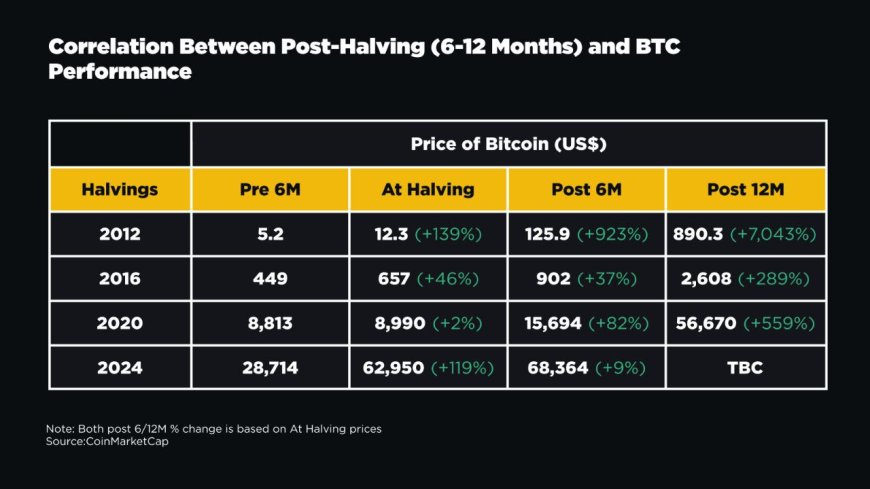

Bitcoin halving events have historically triggered significant price surges within 6-12 months. Past halvings in 2012 (+7,043%), 2016 (+289%), and 2020 (+559%) have demonstrated Bitcoin’s scarcity-driven value increase. As the 2024 halving approaches, investors speculate whether history will repeat itself. With rising global adoption and institutional interest, Bitcoin’s limited supply continues to be its most powerful feature. The real question isn’t if Bitcoin will rise—but how much.

Bitcoin halving events have consistently proven to be pivotal moments in the cryptocurrency market, historically triggering significant price increases within a year. As the next halving approaches, investors and analysts alike are watching closely to see if history will repeat itself.

Historical Performance of Bitcoin Halving Events

Bitcoin's supply structure is designed to reduce new issuance over time, making it scarcer and more valuable. Here’s a look at how Bitcoin performed after each previous halving:

-

2012 Halving: Bitcoin surged +7,043% within a year.

-

2016 Halving: BTC saw a remarkable +289% increase post-halving.

-

2020 Halving: Bitcoin skyrocketed +559% within 12 months.

These historical trends suggest that each halving has acted as a catalyst for exponential price appreciation, primarily due to the reduction in newly minted Bitcoin, combined with increasing demand.

What to Expect in 2024?

The upcoming Bitcoin halving in 2024 will once again reduce the block reward, decreasing the supply of new BTC entering circulation. With global adoption rising, institutional investors entering the market, and Bitcoin becoming more accessible to mainstream users, its scarcity remains its most powerful feature.

While past performance does not guarantee future results, the data suggests that halving events have a profound impact on Bitcoin’s valuation. Many analysts speculate that the 2024 halving could lead to another substantial bull run.

Scarcity and Institutional Adoption

Bitcoin’s built-in scarcity is what differentiates it from traditional fiat currencies. With only 21 million BTC ever to exist, the decreasing supply reinforces its position as “digital gold.” Institutional adoption is also accelerating, with companies and hedge funds increasingly holding Bitcoin as a hedge against inflation and economic uncertainty.

Conclusion

The question isn’t if Bitcoin will rise again—it’s how much. As history has shown, Bitcoin halvings have consistently led to massive price surges. With the 2024 halving on the horizon, all eyes are on whether BTC will once again defy expectations and reach new all-time highs.

For expert insights on Bitcoin, blockchain, and cryptocurrency, visit CentBit.Online - Crypto & Blockchain Expert Bangladesh.

What's Your Reaction?