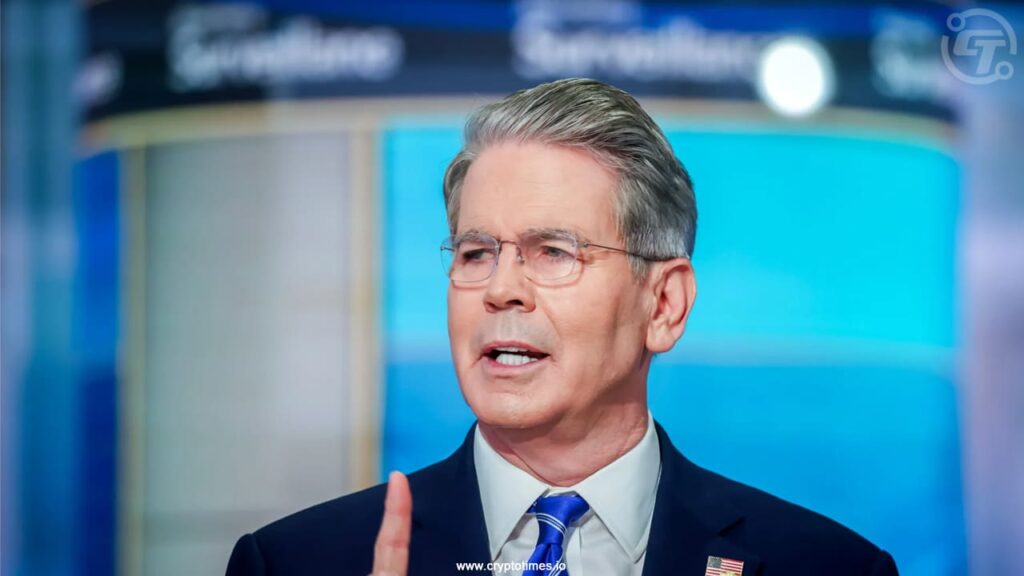

Eric Trump Predicts Bitcoin Will Surpass $175,000 in 2025, Declares Himself a “Bitcoin Maxi”

Eric Trump, son of former President Donald Trump, has made a bold prediction that Bitcoin will surpass $175,000 by the end of 2025, publicly embracing the title of “Bitcoin Maxi.” Speaking at a private finance and technology event in Florida, Trump praised Bitcoin’s resilience and potential to serve as a hedge against inflation and economic…