Source: CentBit.Online – Crypto & Blockchain Expert Bangladesh

Ethereum ($ETH), the world’s second-largest cryptocurrency by market capitalization, has climbed to $3,100, marking a strong resurgence in investor confidence and broader crypto market momentum. This price level reflects renewed optimism in decentralized finance (DeFi), Ethereum-based applications, and the upcoming Ethereum 2.1 upgrade.

What’s Driving the ETH Rally?

-

Institutional Interest Surging Again

After Bitcoin’s rally past $110,000 earlier this year, institutional capital has increasingly rotated into Ethereum. Several major funds and ETFs are now allocating higher percentages to ETH, citing its diverse utility beyond just a store of value. -

Ethereum 2.1 Anticipation

The Ethereum developer community is preparing for the Ethereum 2.1 upgrade, which aims to further reduce gas fees, improve layer-2 integration, and enhance validator rewards. The upgrade is expected to roll out in Q4 2025, boosting long-term investor sentiment. -

Growth in DeFi and NFTs

Despite the bear market of 2022–2023, the DeFi sector has rebounded in 2025. Platforms like Aave, Uniswap, and Lido are witnessing record TVL (Total Value Locked) numbers again. NFT activity on Ethereum has also stabilized, contributing to increased network usage. -

Macro Factors

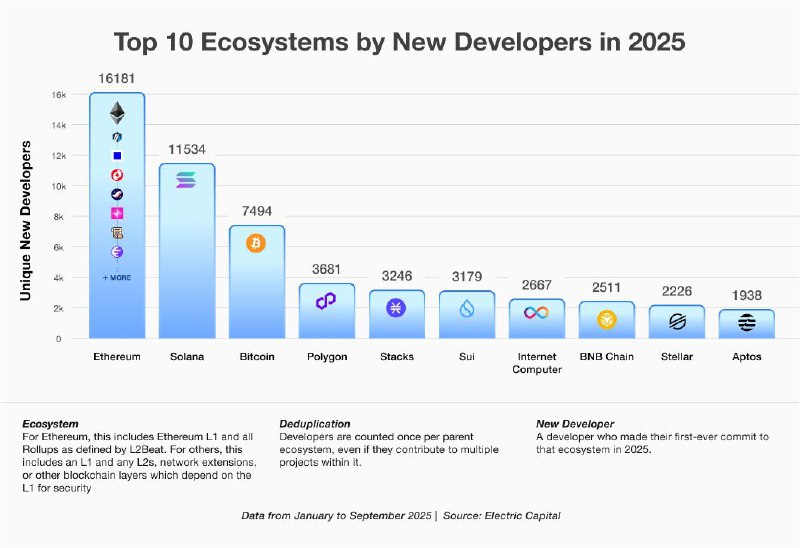

With inflation cooling and interest rates plateauing in the U.S., investors are moving back into high-growth tech and digital assets. Ethereum, with its strong developer ecosystem and real-world use cases, is benefiting from this macro shift.

Market Metrics (as of July 15, 2025)

-

ETH Price: $3,100

-

24-Hour Change: +4.8%

-

Market Cap: $372 billion

-

Total Value Locked (TVL): $91.3 billion

-

Gas Fees: Averaging 18 gwei

What Analysts Are Saying

Michael Saylor, Executive Chairman of MicroStrategy, commented:

“Ethereum is evolving into the financial operating system of the future. $3,100 is just the beginning.”

ARK Invest’s Cathie Wood said:

“Ethereum is where real innovation is happening. With smart contracts, DeFi, and L2s, it’s a foundational asset.”

What’s Next?

If Ethereum maintains momentum, analysts suggest a short-term target of $3,500, with long-term projections ranging from $4,500 to $6,000 depending on the success of Ethereum 2.1 and global regulatory clarity.

However, investors should be cautious of potential volatility around macroeconomic news and any delays in the upgrade timeline.

For real-time updates on Ethereum, Bitcoin, and the global crypto market, follow CentBit.Online – Crypto & Blockchain Expert Bangladesh, your trusted source for expert blockchain insights.